As part of Budget 2021, the Government is set to implement measures that significantly affect motorists. What are these reforms? How do they impact motorists and electric vehicles (EVs)?

ACA Extended Until 2023

The Accelerated Capital Allowances (ACA) for energy-efficient equipment is extended until 31 December 2023.

Under the ACA scheme, businesses that purchase energy-efficient equipment (EEE) get a tax incentive. They can deduct the full equipment cost from their taxable profits on the same year that they acquired it provided that the equipment is on the Triple E Product register for that accounting period.

You can apply for the ACA when you purchase cars for your business for as long as it falls under the “Electric and Alternative Fuel Vehicles” category. The deductible amount from your trading profits is based on the vehicle’s purchase price or up to €24,000 whichever is lower based on business mileage in the first year.

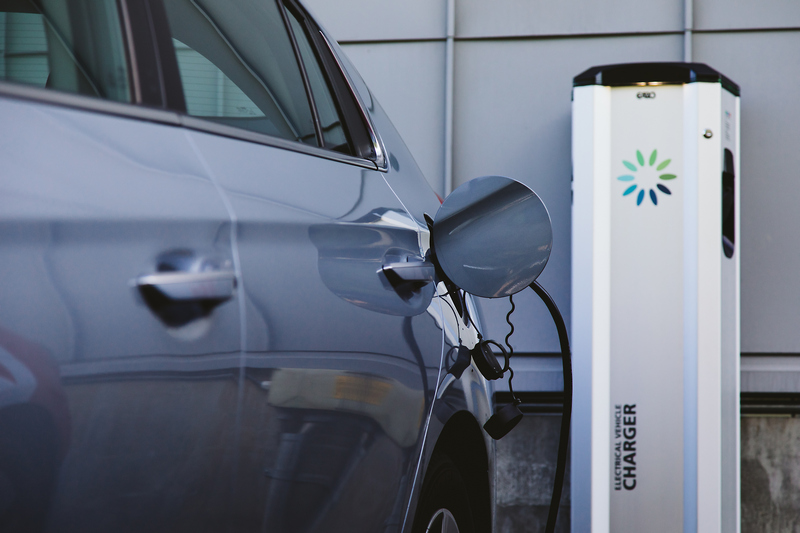

The ACA can also be used for home chargers for company cars. It is highly recommended that you purchase the charger from a trusted EV charger installer to ensure that you are getting a device that is on the Triple E Product Register which is regularly updated.o, it is important that your chosen EV charging installation company monitors these changes for them to help you pick a charger that is going to allow you to apply for the ACA incentive.

Benefit in Kind

0% Benefit in Kind (BIK) is payable on company cars that are fully electric with most car manufacturers’ now having a range of electric vehicles in their portfolio. T&C’s apply.

Independent financial advice should be taken at all times.

New VRT Bands

Starting January 2021, the CO2 values from the Worldwide Harmonised Light Vehicles Test Procedure (WLTP) will replace the NEDC system. The WLTP is the new emissions test for passenger cars in the EU.

With the adoption of the WLTP, there will be an increase in the number of VRT Bands from 11 to 20 and changes in rates structure. The new VRT rates range from 7% to 37% while the current rates range from 14% to 36%.

According to the Government, the new VRT regime should compensate for the phasing out of existing reliefs for purchasing or owning electric cars and hybrids.

The current VRT reliefs for plug-in hybrid electric vehicles (PHEVs) and hybrid vehicles will expire at the end of 2020.

For full-electric cars, the €5,000 VRT relief will also be changing. It will be kept in full for cars with a price of up to €40,000. However, the amount will be reduced for those over €40,000, and no relief will be available for BEVs with an open market selling price (OMSP) of €50,000. Meanwhile, the €5,000 SEAI grant for fully electric vehicles will stay until the end of 2021.

With the new scheme, EVs, PHEVs and hybrids will be charged lower levels of VRT. For some of these cars, the VRT rate will just be 7% – half of what is currently being charged.

The Government hopes that the reduced VRT rates can convince more people looking to buy new vehicles to choose greener options.

Motor Tax Changes

There will also be some reforms to the existing motor tax. Currently, there are two different motor tax categories – based on engine size (for vehicles registered before 2008) and based on CO2 emissions (for those registered after 2008).

The reforms do not affect the vehicles in the pre-2008 regime as their tax rates remain the same. It is a different story though for the most polluting cars registered after 2008 as they will be taxed more.

To be more specific, owners of post-2008 vehicles with CO2 emissions rating of over 141g per kilometre will have to pay €400 instead of €390.

In addition, another motor tax category will be added by next year. Vehicles registered starting 1 January 2021 will be taxed based on their WLTP ratings.

These reforms undeniably make owning a low-emitting vehicle more attractive. If you own a car with 0g/km emissions rating, you only need to pay €120 annually. On the other hand, if you have a vehicle with an emissions rating of anywhere between 201 and 225, you will be taxed €1,200.

Petrol and Diesel Price Hike

Another noteworthy change is the €7.50 rate increase for the carbon tax, from €26 to 33.50 per tonne of CO2. This affects petrol or diesel prices which are expected to go up by 2.5c per litre. This means that owners of these vehicles will spend an additional of €1.30 for a 60-litre tank petrol and €1.51 for a tank of diesel.

The Government intends to implement a tax increase of €7.50 each year up until 2029 and €6.50 in 2030. They believe that these measures can significantly help their efforts to decarbonise the economy.

These sweeping changes under Budget 2021 favour EVs as they make buying and owning high carbon emission vehicles more expensive. Car manufacturers estimate a price increase of as high as €10,000 for their bigger luxury gas guzzlers.

These types of reforms are expected to continue as the Government work towards its goal of net-zero greenhouse gas emissions by 2050. Given these facts, it might be time for you to consider switching to an electric vehicle not just for the financial benefits but also to help the environment.

Are you planning to install EV chargers for your company car? Let us help you pick a charger that is on the Triple E Product Register, so you’ll be eligible for the ACA incentive. Call us now on 1800 99 88 77 to learn more about our EV chargers and installation service!